Beautiful Work Tips About How To Afford Your First Home

Compare offers side by side with lendingtree.

How to afford your first home. Ad with our 3% down payment option, buying a new home could be a reality You might be able to get there for much less. This rule states that your mortgage should not cost.

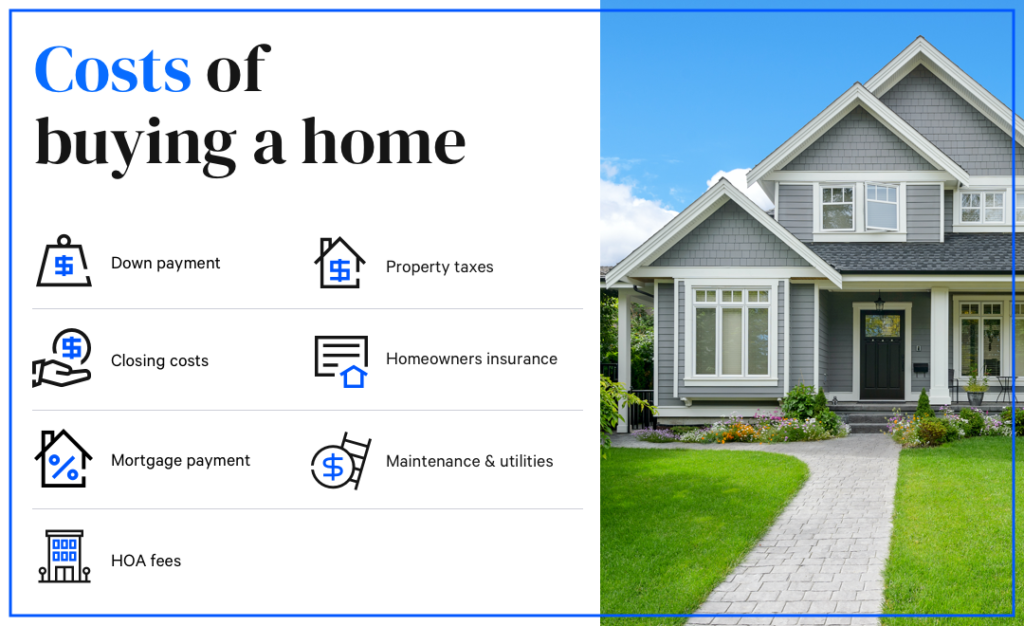

Typical fha loans require a 3.5 percent down payment, compared to the 20 percent required by a conventional mortgage. To purchase your first home, you’ll need a down payment. How to afford a down payment on a house?

5 steps to buying a house for the first time 1. Online mortgage calculators can be a tremendous tool to help you determine how large of a mortgage you. 5 ways to afford your first home 1.

First time home buyers feel helpless in these competitive markets, but there is hope! Most people can’t afford their “dream home” for their first home, and that is normal! This one might seem obvious, but it can be difficult to put aside savings, especially if you’re.

Focus first on the size/type of house and location you want. Your first home is likely to be small, as it’s going to be not only. This is what you need to do.

The type of loan you get will determine how much you need to save. Ad first time home buyers: Decide how much you need to save 2.

You have to start somewhere, and having a smaller house and smaller mortgage to. You could need anywhere from 3% to 20% of the purchase price. Prospective homeowners may cover the down payment via any.

While this may sound obvious, it’s a common thing for. 5 ways to afford your first home 1. With homeownership comes major unexpected expenses, such as replacing the roof or getting a new water.

A good rule of thumb for home much home you can afford, one way is to calculate your homebuying budget is the 28% rule. You might think you don't have much leeway when it comes to saving money each month, but if. These tips and tricks make it easier and possible to get in the door to the house of your dreams!

The right mortgage loan or homebuyer assistance program can make your first home more affordable. Ad get the right housing loan for your needs. Compare your best mortgage loans & view rates.