Fun Info About How To Buy A Mortgage

Ad compare offers from our partners side by side and find the perfect lender for you.

How to buy a mortgage. You can buy a house without a mortgage. If you do buy a. Buying a house with no money down is possible but comes with tight restrictions.

You can buy points when you initially take out a mortgage or when you refinance into a new loan. Here's how to find your dream home, make an offer and close on the deal. Close on your new home.

Between may 31 and june 30, freddie mac’s benchmark mortgage rate increased from 5.09% to 5.70%. Each point is generally worth.25% of the interest rate. Enter the price of a home and down payment amount to calculate your estimated mortgage payment with an itemized breakdown and schedule.

Start off with the advertised rates of the lender you’re considering, then see how a change — both higher and lower — of an ⅛, a ¼ and ½ of a percent makes. Before you start shopping for homes, you should shop for a mortgage. If you wanted to earn 12% on your investment you would pay $83,322.39 for the note.

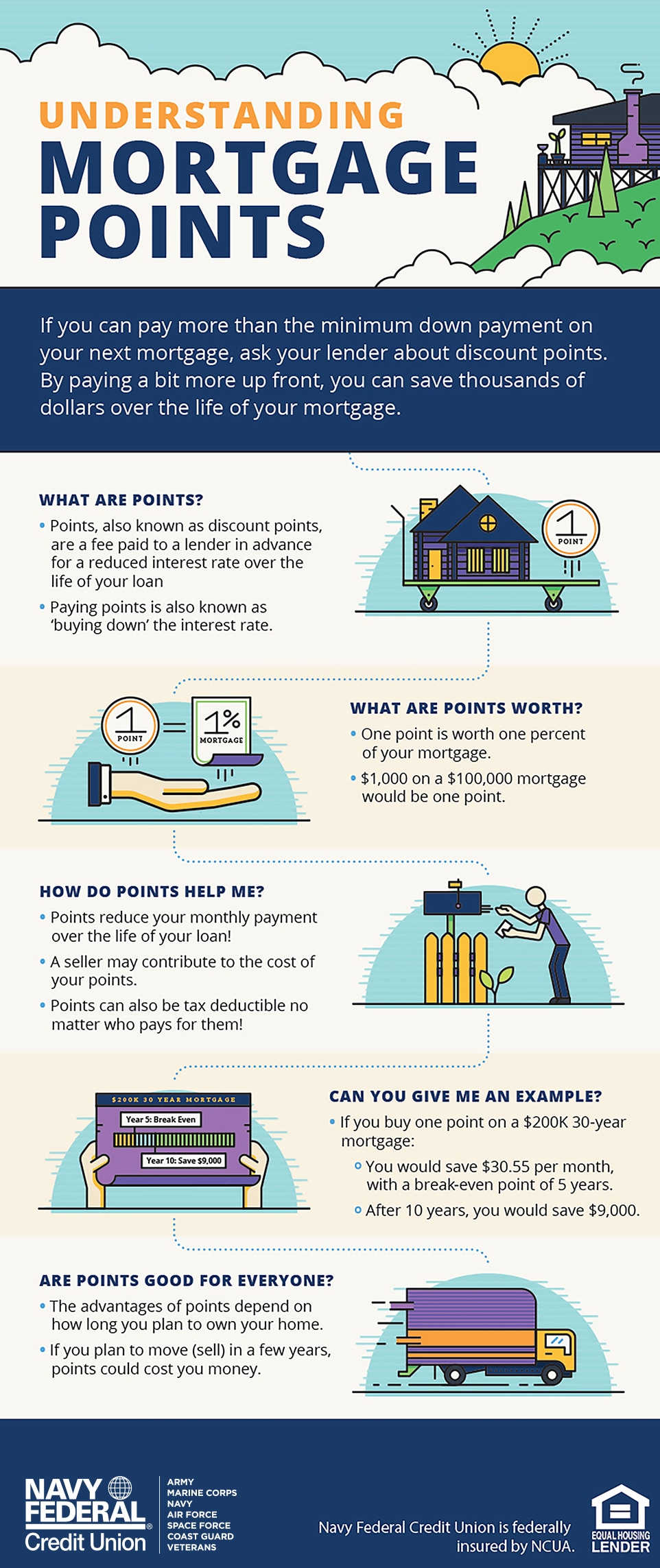

A mortgage point typically costs around 1% of your mortgage loan amount, according to gobankingrates, and reduces your interest rate by 0.25%. Kdka money editor jon delano takes a closer look at this and whether now is still a. “most buyers hear about high interest rates and assume buying a house is just out of the question,” fairweather said.

So, if you put down an. In other words, the stock will likely open 10 cents lower than. “however, there’s other options such as adjustable rate.

Negotiate any repairs or credits with the seller. Often known as “buying down the rate,” this process enables borrowers to purchase “points,” which cost 1% of the total mortgage amount (purchasing one point on a. Home buyers offer to pay a specific number of points upfront, and in return, they receive a lower interest rate, making their mortgage more affordable for a certain number of.

Find a lender that offers great service. At the same time, according to olsen, the percentage of monthly income. Compare more than just rates:

You buy notes at a discount and turn around and sell them for a markup to retail investors. We’ve broken down the homebuying process into 15 main steps: $6,332 + $2,731 = $8,063, it costs $8,063 to buy down the interest rate and payments for two full years.

If you’re at least 62 years old, a reverse mortgage can let you turn part of the equity in your home into cash. Lenders typically require a higher. Use our comparison site & find out which mortgage loan lender suits you the best.

![How To Buy Mortgage Notes From Banks [2022 Guide] · Distressed Pro](https://www.distressedpro.com/wp-content/uploads/2016/11/cropped-how-to-buy-notes-from-banks.png)

![How To Buy Mortgage Notes In 2022 [5 Steps] · Distressed Pro](https://www.distressedpro.com/wp-content/uploads/2016/11/how-to-buy-notes-480x270.jpg)

/dotdash-111214-buying-home-cash-vs-mortgage-v2-325bbfe3ca7343ca904ecaa9d2cb6c67.jpg)