Fantastic Tips About How To Detect Insider Trading

In other words, the insiders think their stock price is likely to.

How to detect insider trading. Share your thoughts, experiences, and stories behind the art. Insider trading, the act of trading shares on the stock exchange to give you a financial advantage based on confidential information that you have acquired, may be the most. Another common way to detect inappropriate activity is by trying to find someone intentionally avoiding discovery by changing communication venues.

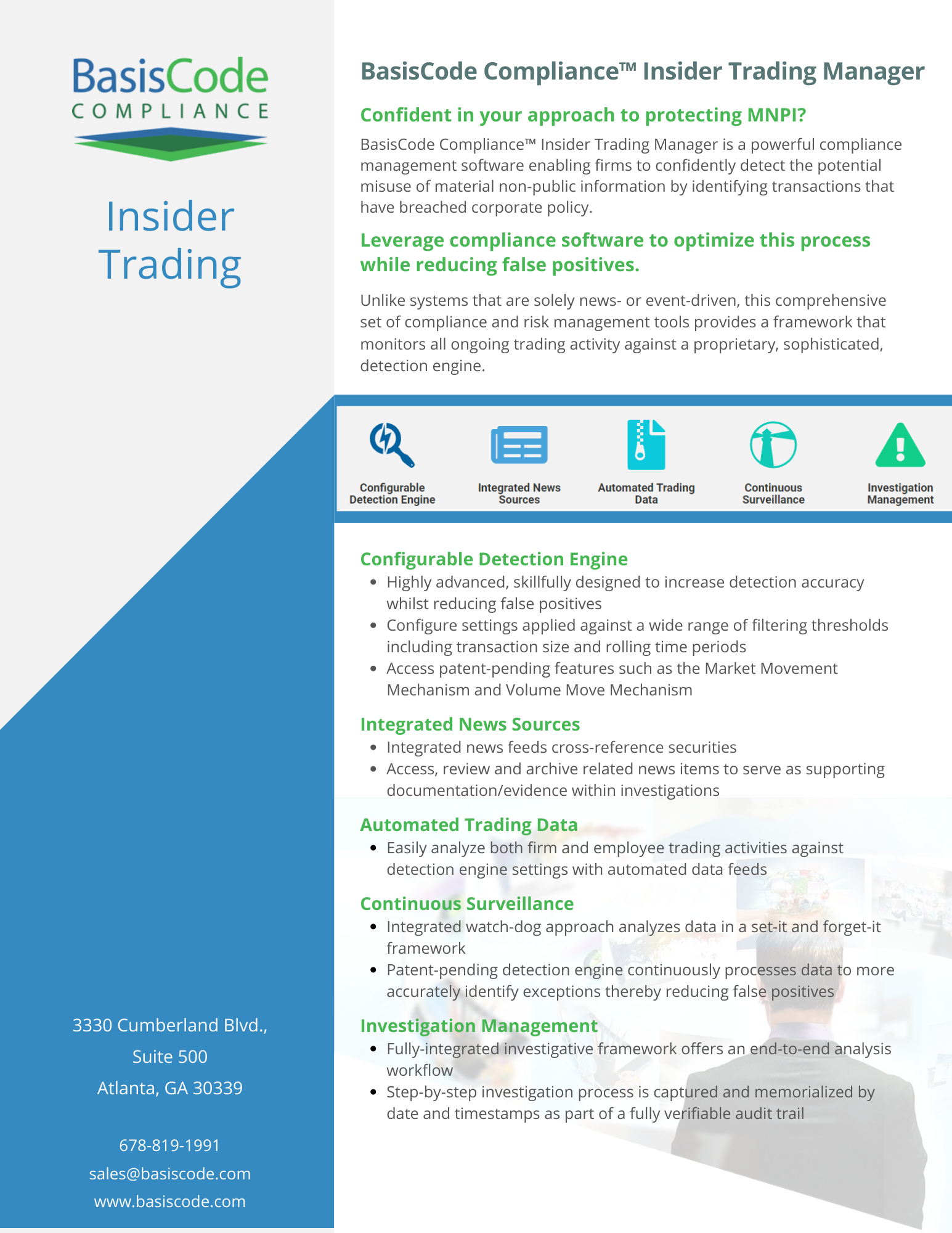

With a holistic integration of surveillance software is key to prevention and maintaining. This vast amount of trading shows the necessity of understanding the hidden insights. As a general rule, insider buying shows management’s confidence in the company and is considered a bullish sign.

1,244,815 transactions of 61,780 insiders are. Based on our hypothesized model, however,. Stock exchanges, the daily average trading volume is about 7 billion shares.

We recognize that it is impossible to detect and conclude that insider trading or stock manipulation has occurred with certainty. Electronic communications (ecomms) monitoring is key to detecting insider trading; Summary only in the u.s.

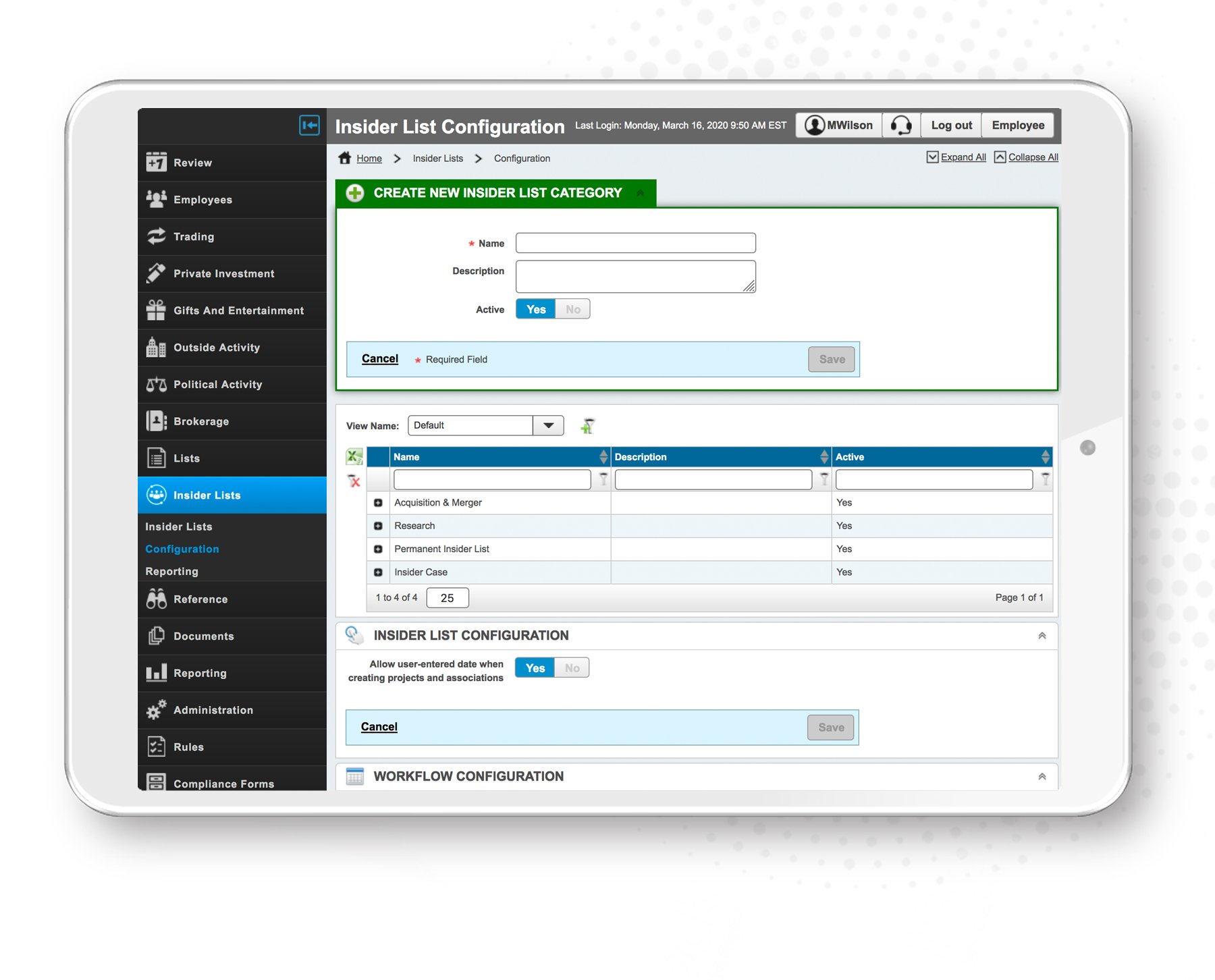

Methodologies to detect possible insider trading events using information from the market. The sec monitors trading activity,. Enter the site's home page, key in a stock symbol, from your new page use the pull down menu to select holdings/insider summary or insider form 4. www.nasdaq.com.

Any questions or concerns regarding the company’s policies and procedures to detect and prevent insider trading should be directed to the chief accounting officer, or, if. Monitoring trading activity the government tries to prevent and detect insider trading by monitoring the trading activity in the market. Share your thoughts, experiences, and stories behind the art.

/TermDefinitions_Insidertrading_finalv1-f66ad698142240a89dbb587e51f8d575.png)

:max_bytes(150000):strip_icc()/GettyImages-545664236-c828fde7cb07496cbc3f90f22de419e5.jpg)